Black Swan: Sunday Morning Philosophizing

Kristen Sparrow • February 17, 2013

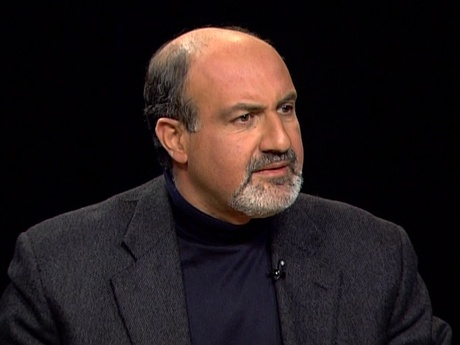

Spent the morning reading “Black Swan” by Nassim Taleb, a mathematical trader by profession, but an essayist and “intellectual.” His book outlines how difficult it is to override our innate, evolutionary tendency to make assumptions and draw conclusions that leave us unable to predict highly unusual events. But in outlining his ideas, he touches on a number of issues that pertain to the philosophy of science that I found provocative and pertinent to how I try to think about what I do: treat with acupuncture. But more than that, I’m trying to figure out models of what is happening with acupuncture to be able to make it work better. That’s why I’m interested in biomimicry, hormesis, the autonomic nervous system, and, of course acupuncture research.

Spent the morning reading “Black Swan” by Nassim Taleb, a mathematical trader by profession, but an essayist and “intellectual.” His book outlines how difficult it is to override our innate, evolutionary tendency to make assumptions and draw conclusions that leave us unable to predict highly unusual events. But in outlining his ideas, he touches on a number of issues that pertain to the philosophy of science that I found provocative and pertinent to how I try to think about what I do: treat with acupuncture. But more than that, I’m trying to figure out models of what is happening with acupuncture to be able to make it work better. That’s why I’m interested in biomimicry, hormesis, the autonomic nervous system, and, of course acupuncture research.

Some of the points in the early chapters I found interesting were,

1. Chess grand masters and George Soros focus on where their speculative moves might be weak, and don’t concentrate on confirmative cases. It takes true self-confidence to look at the world without it confirming that you are right. I like to think that this is one of the reasons that I try to find the difference between nonresponders to acupuncture, and responders. I’m looking for those that don’t work to see what, if anything, we can learn.

2. Dopamine again. Turns out that a higher concentration of dopamine appears to lower skepticism and results in higher vulnerability to (false) pattern detection, leading to problems such as gambling, “astrology, superstitions, economics, and tarot-card reading.” A patient is suing his doctor claiming the L-Dopa he took caused him to recklessly gamble. (Underscores my worry about taking medications with broad reaching effects, hormones, psycho active medications, unless you really need them.)

3. The ingrained need to “reduce dimensions and inflict order on things,” is common in in science as well as the arts. Though we’re trying to get to the truth of things, we feel better when things fit a pattern (even if it’s not the truth) . “We tend to use knowledge as therapy.” I think I’ve covered this quite a bit on the blog, like in this post “Believing in Treatments that Don’t Work.” But there have been others too like this post, and this one. In fact, I should probably start a new category of blog posts devoted to the subject.

4. Slightly off topic, but also interesting to me because of an anecdote I will tell in a minute, is the authors sporting of a gray beard. He says it makes him look older and in many societies, respect for elders is a kind of compensation for our short term memory. “Elders are repositories of complicated inductive learning that includes information about rare events.” It turns out that this also holds true in the animal kingdom, elephant matriarchs play the role of superadvisers on rare events. In native American tribes, elder women had a prominent role in matters of “state” also. My anecdote is merely that a few years ago I took an extension class on portfolio management at UC Berkeley. After the class was over they had a sort of “Career” night, and even though I hadn’t finished the course work for a Financial Planner, I could go to the evening event. To my surprise, a number of the employees working the event asked me if I was a Financial Planner and would I manage their affairs. This was a shock to me because, as a middle aged woman, I am basically invisible and to have people actually approach ME was remarkable. There may be an innate sense that people have that when it comes to their finances they would prefer a sedate middle aged woman. I thought it was interesting. And, no, I didn’t reconsider my profession.